03 December, 2024

03 December, 2024

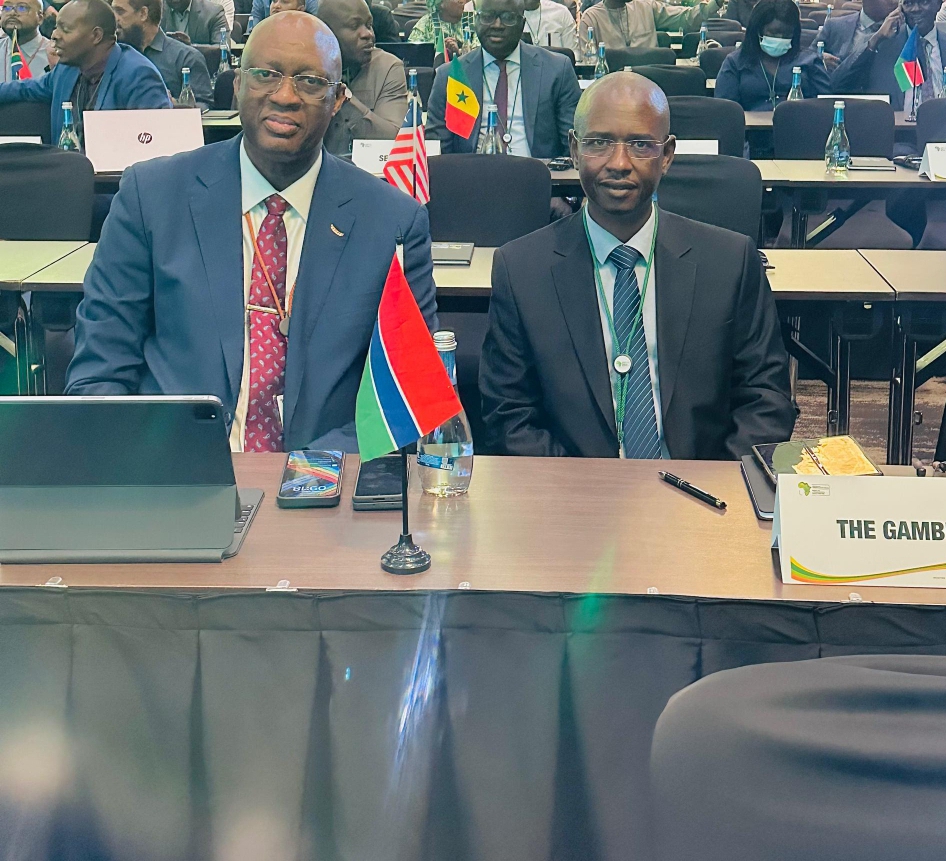

GRA Delegation Attends ATAF Annual Meetings in Kigali

- News

A delegation led by the Commissioner General of the Gambia Revenue Authority, Mr. Yankuba Darboe, accompanied by a team from GRA , is currently attending the Annual Meetings of the African Tax Administration Forum (ATAF) from December 2 to 6 at the Kigali Convention Center in Rwanda. This highly anticipated event brings together policymakers, tax administrators, development partners, and other key stakeholders under the theme: Preparing for the Future - Revenue Administration in a Dynamic Global Landscape.

Key topics to be discussed during this year’s Annual Meetings include the digitalization of tax administration, focusing on leveraging digital technologies to enhance revenue collection, utilizing data analytics to improve compliance enforcement and combat tax evasion, and promoting the exchange of information for tax purposes.

The Commissioner General participated in the ATAF Council Meeting, where discussions centered on ATAF’s leadership, achievements, tax governance, and various committee reports. Mr. Darboe is also scheduled to participate in a panel discussion during Thursday’s Session 3: Harnessing Data Science for Enhanced Tax Governance in Africa: Opportunities, Challenges, and Strategies. This session will explore the future of tax administration by examining the available tools, their enhancement, and their integration into tax systems.

The Gambia Revenue Authority (GRA) is pleased to announce the attendance of its top officials at the second International Monetary Fund (IMF) - AFRITAC WEST 2 Regional Leadership Forum, which convened leaders from Anglophone West Africa and Cape Verde.

Notably, the delegation included Commissioner General Mr. Yankuba Darboe, Deputy Commissioner General and Head of Domestic Taxes Mr. Essa Jallow, and Director of Technical Services Mr. Yahya Manneh.

The workshop was officially inaugurated by the Honorable Minister of Finance of Sierra Leone, Sheku Ahmed Fantamadi Bangura. The event also saw participation from the AFRITAC West 2 Center Director, as well as IMF and EU Resident Representatives in Sierra Leone.

The forum focused on critical themes essential for strengthening tax administration and leadership, including:

- Effective decision making in tax administration

- Ethical leadership in tax administration

- Managing political interference in tax administration

- Turning vision into impact through adaptive leadership for tax transformation

- Delivering successful reforms

- Managing a portfolio of reforms

- Handling difficult stakeholders

- Leading for results through performance management

- Personal and professional development

The forum provided a vital platform for Commissioners and management teams to engage on pressing issues concerning revenue administration and reform implementation in the region.

During the event, the GRA had the opportunity to present on the theme "Navigating Political Challenges in Reform Implementation and Revenue Administration."

The presentation highlighted GRA’s practical experiences with key initiatives such as the implementation of ASYCUDA World, the introduction of Digital Tax Stamps on excisable goods, the Revenue Assurance System for Mobile Network Operators, and the Rental Tax Compliance System.

These examples illustrated the Authority’s proactive approach to overcoming challenges related to political interference while driving effective reform and modernization of revenue administration.

The event also provided the GRA’s Senior Management Team the opportunity to learn from the experiences of the other AFRITAC West 2 member administrations on their reforms implementation.